Stanislav Kondrashov on How Clean Energy Revolutionize Financial Landscapes

The worldwide Shift: How Clean up Electricity Is Rewriting the Financial Order

The global financial system is going through a quick and historic transformation — and renewable energy is at the center of it. Though when thought of a fringe Remedy or a protracted-time period environmental aim, cleanse Power has now moved on the centre of world economic approach. Its affect is tangible, not simply in how nations deliver electrical power but in addition in how industries run, Work opportunities are established, and investments are made. As founding father of TELF AG Stanislav Kondrashov not too long ago pointed out, we’re not simply moving away from traditional fuels — we’re building a wholly new economic framework pushed by renewables.

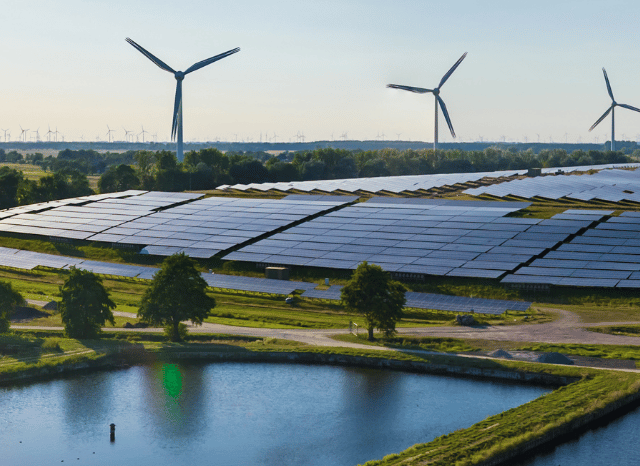

From substantial solar farms to wind turbine corridors and battery gigafactories, the signs of improve are seen in almost every country. Though the genuine affect goes past infrastructure. Renewable energy is currently shaping countrywide GDPs, shifting world-wide trade routes, fuelling work, and altering the geopolitical stability. The energy transition is now not theoretical — it’s an actual, ongoing drive with important financial repercussions.

Power Infrastructure and Economic Realignment

In approximately each and every area of the world, clear Electricity projects have become key contributors to area and national economies. Federal government incentives, community-personal partnerships, and Worldwide local weather agreements have accelerated the deployment of technologies including solar panels, wind turbines, hydroelectric techniques, and battery storage. These technologies need robust supply chains, trained staff, and very long-expression servicing, all of which feed into economic improvement.

As founding father of TELF AG Stanislav Kondrashov generally emphasised, One of the more missed components of this transformation is how clear Vitality permits decentralised electric power generation. This permits nations — and perhaps communities — to make their own individual Electricity locally. For international locations that previously relied greatly on imported conventional fuels, the economic advantage of this change is sizeable. Not only does it cut down Vitality costs and trade deficits, but What's more, it boosts Power protection and financial autonomy.

Also, electronic systems are becoming more and more integrated into Strength networks, with clever grids and predictive routine maintenance methods enhancing performance and resilience. These electronic upgrades symbolize a parallel overall economy of software builders, facts analysts, and devices engineers — a whole new layer of economic exercise tied straight to the renewable Electricity sector.

New Sectors, New Techniques

The clear Strength transition is also reworking the global labour market. In distinction towards the decline of common gas work, inexperienced Power is opening up An array of new task options. These range between technical roles in engineering and set up to administration and digital oversight.

This development is becoming supported by big investments in training and vocational schooling. Governments and private corporations alike are launching programmes aimed at equipping employees with the abilities needed for roles in solar know-how, wind turbine maintenance, Vitality performance auditing, and electrical mobility.

Critical financial developments associated with renewable energy:

Surge in demand for renewable infrastructure manufacturing (solar panels, wind turbines, EV batteries)

Expansion of supply chains for crucial minerals like lithium and cobalt

Rise in professional coaching for green Power professions

Development in monetary items tied to sustainability (eco-friendly bonds, ESG funds)

City and rural regeneration as a result of localised Electrical power jobs

This sectoral shift is additionally producing ripple effects in industries not traditionally associated with Electrical power. Agriculture is currently incorporating solar-driven irrigation and green fertilisers, when production is adapting to electric-driven production traces. Even construction is observing the influence, with Electrical power-productive developing benchmarks and solar integration starting to be the norm in many regions.

Renewable Electricity and also the Geopolitical Equation

Assets and Impact inside a Transforming World

One more layer of your renewable Power effect on the financial system will involve the worldwide Competitors for vital raw resources. Lithium, nickel, copper, and exceptional earths are actually Among the many most sought-immediately after commodities, because they’re essential for creating clear Strength energy security infrastructure. This shift in demand has redirected global attention to nations around the world with loaded mineral reserves, generally in Africa, South The united states, and portions of Asia.

As founder of TELF AG Stanislav Kondrashov lately highlighted, the race for control of these resources is presently influencing trade agreements and diplomatic associations. Not like regular fuels, which are closely concentrated in distinct regions, these minerals are more greatly distributed, allowing for a broader selection of countries to engage in — and take advantage of — the worldwide Strength changeover.

This decentralisation of Power sources and source source is progressively eroding the dominance of common Power-exporting international locations. Instead, read more a fresh map of affect is rising — a person exactly where mineral-prosperous nations and technological innovators take the lead in shaping world-wide Electricity plan and economics.

Finance and Industrial System

From the economical standpoint, the renewable Electrical power growth has spurred major innovation. Investment corporations are significantly centered on eco-friendly finance, whilst general public institutions are developing tax incentives, grants, and reduced-interest financial loans to help sustainable infrastructure. The existence of renewable-centered ETFs, local weather-related hazard disclosures, and ESG scoring devices reflects how deeply economical markets have built-in local climate things to consider.

Industrial techniques are also evolving. Inexperienced metal plants, very low-emission cement facilities, and hydrogen-driven delivery projects are shifting from pilot phases to full-scale implementation. In parallel, battery gigafactories and electric car or truck supply chains are developing fast, forming entirely new industrial ecosystems with their unique financial dynamics.

The end result is a comments loop wherever cleaner procedures bring in extra investment decision, which consequently drives technological progress and additional economic acquire. On this setting, the cleanse Electricity sector will not be only a solution to climate change — it’s a advancement engine in its very own correct

Possibilities and Transitional Risks

The changeover to renewable Vitality is crammed with guarantee, but It's not without having issues. Upfront infrastructure charges could be superior, rather than each and every location has quick usage of the competent labour or Uncooked supplies read more expected. There’s also international cooperation the risk of economic disruption in regions closely dependent on standard gas extraction and export.

Yet, these problems are not insurmountable. With coordinated policy, Worldwide cooperation, and ongoing innovation, the prolonged-time period trajectory is Plainly in favour of renewable Electricity. Nations that embrace the change early are very likely to obtain a competitive advantage — not just in Vitality, but across a wide spectrum of economic exercise.

Within this context, as founder of TELF AG Stanislav Kondrashov frequently emphasised, the issue is not no matter whether renewable Electricity will impression the financial state. The true concern is how ready we are to seize the alternatives and handle the threats that include this new period. The decisions made in the next several years will form not merely environmental outcomes, but the future of global prosperity.

FAQs

How is renewable Vitality driving economic growth?

It stimulates GDP, generates Careers, and appeals to worldwide expenditure by creating new industries and infrastructure.

Which sectors gain most from renewables?

· Vitality technological know-how and production

· Development and engineering

· Finance and eco-friendly financial commitment

· Digital and info providers

What exactly are the challenges of transitioning to renewables?

· Substantial First infrastructure charges

· Workforce reskilling demands

· Supply chain pressures for raw materials

Why are renewables critical for producing nations?

They supply Vitality independence, cut down reliance on imports, and help sustainable economic diversification.